- About Nova

- Products

- Specs

- Resources

- ADA Webinar Series

- Accessibility Codes

- BIM Objects

- Clean Air GOLD Certified

- ISO 9001:2015 Certified

- How To Make Photopolymer Signs

- How To Process Novacryl Photopolymer

- Novacryl Preferred Fabricators

- Novacryl® Specifications

- On-Site Training

- Photopolymer FAQ

- Photopolymer Equipment Financing

- White Papers

- Gallery

- Blog

- Support

- Contact

Nova Polymers works with leasing sources that are able to offer aggressive and creative loan programs, in addition to the Section 179 Tax Credit that can lowers the total purchase amount.

Why finance?

Smart businesses, like yours, are discovering the advantages of funding the equipment needed today with tomorrow’s dollars using a leasing program that includes a $1.00 buyout and immediate transfer of ownership at the end of the term.

- Free up working capital

- Gain tax advantages

- Match payments to cash flow

- 100% financing, including shipping and installation

- Competitive Rates

- Fast and liberal credit decisions

- Simple online application

- No obligation, no risk

Programs

Get the payment structure that meets your cash flow needs.

- 24-84 month terms

- Seasonal & Annual programs

- 4 hour response time

- Same-day funding

Contact

For more information please contact:

Tim Lloyd

Director – Nova Polymers, Inc.

[email protected]

630.470.4980

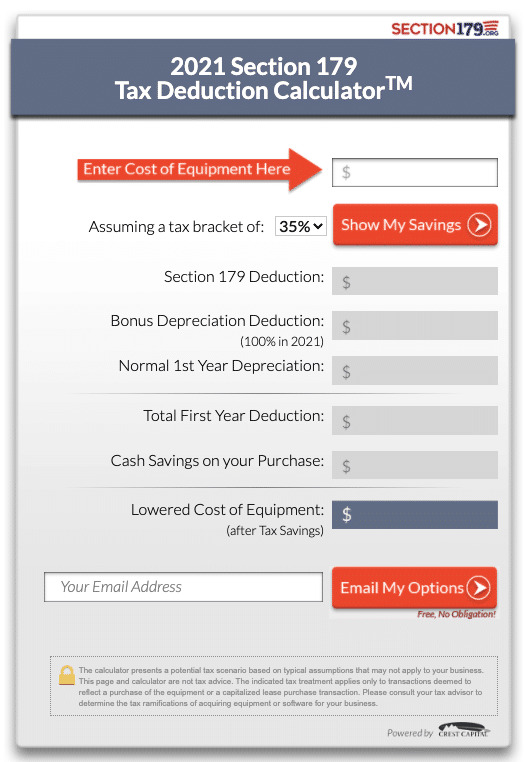

Taking Advantage of Section 179

Your Tax Dollars at Work

Let me just take a wild guess. Chances are you probably aren’t thinking too much about your taxes at the moment. But you should be, even though taking advantage of the ins and outs of the tax code requires a shallow dive into the details.

There’s a feature of the 2008 Stimulus Act called Section 179 intended to encourage small businesses to invest in the equipment they need to grow. It allows taxpayers to deduct the cost of certain types of property on their income taxes as an expense, rather than requiring the cost to be capitalized and depreciated. Congress raised this deduction to $500,000, but on January 1, 2015, it was reduced to $25,000. On top of that, a built-in depreciation bonus that allowed a company to deduct 50% of new equipment cost using the Section 179 deduction expired on December 31, 2014. So it looked like game over.

But it isn’t!

Section 179 deduction is at $1,050,000 and will stay there through 2021. And, tucked into a last-minute move in Congress, its benefits and incentives have been extended and enhanced, encouraging and enabling companies of all sizes to grow by purchasing, leasing, or financing efficient new equipment. So, it may be time to cut a purchase order. (For details, be sure to visit section179.org) and set aside some quality time with your accountant and tax advisor.

Section 179 deduction is at $1,050,000 and will stay there through 2021. And, tucked into a last-minute move in Congress, its benefits and incentives have been extended and enhanced, encouraging and enabling companies of all sizes to grow by purchasing, leasing, or financing efficient new equipment. So, it may be time to cut a purchase order. (For details, be sure to visit section179.org) and set aside some quality time with your accountant and tax advisor.

The Wish List

To fuel your wish list, some of what qualifies under Section 179 can include:

- New and used equipment (but must be new to you, whether purchased, leased, or financed)

- Tangible personal property used in business

- Computers

- Software

- Office furniture and office equipment

- Business vehicles with a gross vehicle weight in excess of 6,000 lbs

- Property attached to your building that is not a structural component (printing press, large manufacturing tools)

- Partial business use (equipment purchased for business and personal use: generally, the deduction will be based on the % of time it’s used for business)

So while you can’t expense a new Jaguar F-Type or Porsche GT3 R since they weigh less than 6,000 pounds, you can buy and expense some photopolymer equipment and start bringing processing in-house!

And, once the new investment is on-site, bonus depreciation enables companies to deduct a substantial amount of a new asset. To see how the deductions could apply to your business, use the calculator at section179.org.